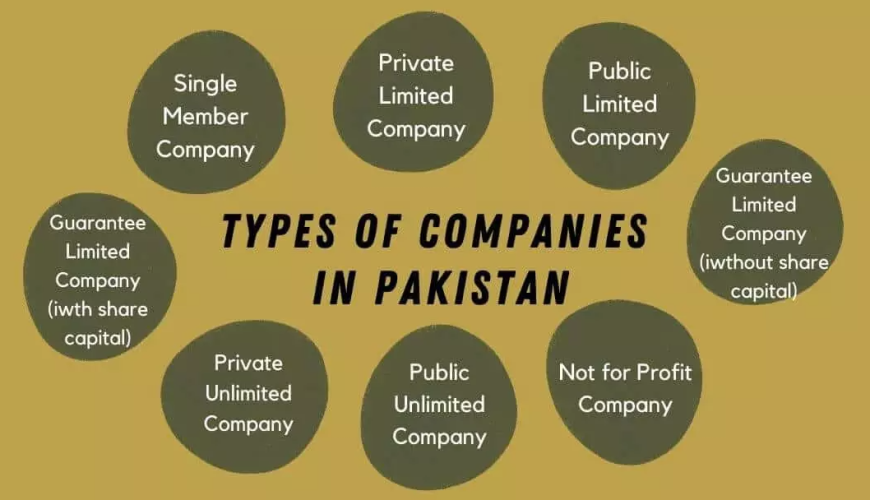

Starting a business in Pakistan requires careful consideration of various factors, including legal structure, taxation, regulation, and future plans. Entrepreneurs have several options to choose from, such as sole proprietorship, partnership, limited liability partnership (LLP), private limited company, and public limited company. Each structure has its own advantages and disadvantages, and selecting the most suitable one depends on the specific needs and goals of the business.

One of the key factors to consider when choosing a legal structure is liability. Sole proprietorships and partnerships typically offer unlimited liability, meaning the owners are personally liable for the debts and obligations of the business. On the other hand, companies like private limited companies and public limited companies provide limited liability, protecting the personal assets of the owners from business liabilities.

Tax implications also play a significant role in the decision-making process. Different business structures are subject to different tax regimes, and choosing the right structure can have a significant impact on the amount of tax paid by the business and its owners. For example, private limited companies are subject to corporate tax rates, while sole proprietorships and partnerships are taxed at the individual level.

Ownership structure is another important consideration. In a sole proprietorship, the business is owned and operated by a single individual, whereas partnerships involve two or more individuals sharing ownership and management responsibilities. Companies, on the other hand, have a separate legal identity from their owners, who are known as shareholders. The ownership structure chosen can have implications for decision-making, control, and succession planning.

Compliance with legal and regulatory requirements is essential for any business operating in Pakistan. The Companies Act, Partnership Act, and Limited Liability Partnership Act govern the formation and operation of businesses in the country. In addition, businesses must comply with various tax, labor, environmental, and intellectual property laws, as well as industry-specific regulations. Failing to comply with these laws can result in fines, penalties, and even legal action, so it’s important for entrepreneurs to understand and adhere to their legal obligations.

Seeking professional advice is highly recommended when starting a business in Pakistan. Experienced lawyers, accountants, and business consultants can provide valuable guidance on choosing the right legal structure, navigating the regulatory landscape, and ensuring compliance with applicable laws and regulations. They can also help with drafting legal documents, such as partnership agreements and articles of incorporation, and provide ongoing support as the business grows and evolves.

The choice of legal structure can also have implications for the business’s credibility and perception in the marketplace. Public limited companies, for example, are often perceived as more stable and trustworthy, making them attractive to investors and customers. Private limited companies, on the other hand, offer greater flexibility and confidentiality, which can be advantageous for smaller businesses or those operating in sensitive industries. Sole proprietorships and partnerships may be seen as less established, but with the right strategy and execution, they can still thrive and succeed in the marketplace.

In conclusion, starting a business in Pakistan requires careful consideration of various factors, including legal structure, taxation, regulation, and compliance. Entrepreneurs must weigh the advantages and disadvantages of different structures and seek professional advice to make informed decisions. By choosing the right legal structure and adhering to legal and regulatory requirements, businesses can set themselves up for success in the dynamic Pakistani market.

Our law firm, “The Lawyers” stands ready to assist you in this endeavor. With our expertise in corporate law and business advisory services, we can provide comprehensive assistance in choosing the right legal structure for your business and facilitating the registration process. From drafting legal documents to ensuring compliance with regulatory requirements, our team is dedicated to helping you achieve your entrepreneurial goals. Contact us today to explore how we can support your journey towards success in the Pakistani business landscape.